Améliorer

Introduction to

Investing

Our Introduction to Investing series aims to help expose people to the basics of investing. The majority of this course content is built on the Boglehead philosophy, which can be found here. In this course, we strive to explain a variety of the most common investment vehicles available to retail (regular) investors. This course is primarily designed for young people with relatively low net worths and little investment knowledge. Options and derivative trading, as well as algorithms and trading models, are beyond the scope of this course. We will present sections of this course in our weekly Wealth Creation seminars, so stop by in person for additional information and to ask questions!

This is a synthesis of information available online and not qualified investment advice. We are not licensed financial advisors, so please speak to one before investing.

Basic Investment Terminology Glossary

All terms are loosely defined relative to basic investing; these are not legally defined terms. More in-depth information can be found below and online

Plan Before You Invest

Before making any investment, it’s crucial to have a clear plan in place. Think about why you’re investing; is it to buy a home, save for retirement, or simply build wealth over time? Having a clear understanding of your goals will help guide your investment decisions.

Before investing, you need to have a solid understanding of your personal finances and come up with a financial plan. A financial plan covers all financial aspects like investing, investment philosophy, taxes, savings, retirement, your estate, charity, insurance, and more. Financial planning is very complicated, and there are licensed professionals who can help you manage it all. Still, before investing, it is crucial to understand your current finances and future goals, as well as have a solid investment philosophy. This course is based on the Boglehead investment philosophy, which is based on John Bogle's (the founder of Vanguard) personal investment philosophy. More about the Boglehead investment philosophy can be found here. We aim to cover some of the basics of their guide as well as explain key information about investing. For a more comprehensive dive into investing and financial planning, please check out the Boglehead wiki and other online resources.

It’s also essential to recognize that investing always carries risk. You could potentially lose your entire investment, so understanding the risk level of each asset is critical. Some investments, like bonds, come with lower risk, while others, collectibles, carry much higher risk. Be sure to thoroughly research before investing in any asset, no matter how small.

Additionally, you’ll want to consider your investment timeline. How long are you planning to keep your money invested? For example, if you’re looking to buy a home or start a family soon, you’ll want to avoid having all your money locked in a retirement account that penalizes early withdrawals. Some investments can hold your funds for decades, so it’s important to know the timelines associated with each option before you begin.

In short, do your homework, make a plan, and ensure your investments align with your goals and timeline.

Risk Management and Diversification

When it comes to investing, managing risk is crucial. Nearly every qualified investor, including the Securities and Exchange Commission (the regulatory body overseeing the markets), will recommend diversifying your portfolio to help reduce risk. It’s important to remember that every investment carries the possibility of complete, total loss; you could potentially lose everything you invested.

Investments are commonly given risk levels by independent rating agencies to help investors determine their potential risk. It is important to understand your investment timeline and how much risk you are willing to take. Your investment timeline and risk levels will directly determine your asset allocation. More on risk levels and assessment can be found online.

We’ve all heard the saying, "Don’t put all your eggs in one basket." This principle is key when it comes to investing. If you place all your money in a single stock, bond, or other investment, you run the risk of that asset underperforming, which could lead to significant losses.

That’s why diversification is so important. By spreading your investments across different types of assets, you lower the chance of a major loss. Always take the time to research what you’re investing in before committing your money. The goal is to minimize risk by diversifying your portfolio, so you’re not overly reliant on one type of investment.

Employer-Sponsored Investing

Let's spend some time discussing employer-sponsored investing because it can be one of the most effective ways to build your retirement savings. Many jobs, especially those in the professional sector, offer retirement plans that include a company match, like a 401(k) Plan. This means they’ll match your contributions up to a certain percentage or dollar amount. This is a fantastic benefit as your employer is essentially giving you free money relative to your contribution. The money you contribute is typically tax-free, allowing you to deduct the invested amount from your paycheck and only pay taxes on your remaining income.

401(k) Plans are the most common employer-sponsored retirement investment accounts where employees can contribute a percentage of their income towards their retirement. Employers usually will match your savings contribution up to a certain percentage or fixed dollar amount. 401(k) Plans come in both traditional and Roth account setups and have restrictions on when the money can be withdrawn. More about the differences between traditional and Roth accounts can be found in the glossary and online. 401(k) Plans function similarly to investment accounts, allowing the contributor to choose what assets to invest in. Each employer offers a limited variety of investment options to choose from, such as stocks, funds, or bonds. They are required by law to act in their employees’ best interests when selecting these options. Employers have a fiduciary responsibility to ensure the investments available are top-notch. So, when you’re employed, make sure you’re contributing to your employer’s retirement plan if they offer one.

401(k) Plans function very similarly to individual retirement accounts, but with much less assets to invest in. There are also a variety of different 401 plans, especially for the self-employed or small business owners. A 403(b) plan is essentially the same as a 401(k), but for people who work at non-profits.

Investing in your retirement through your employer should always be a top priority. Not only are your contributions usually tax-free, but your employer is giving you free money by matching those contributions. If you don’t take advantage of employer-sponsored retirement investing, you’re not only paying more in taxes but also missing out on that free match.

What happens if I leave or am fired from the company?

When you leave a job, what happens to your 401(k) or 403(b) depends on your vested balance. Your vested balance is the portion of the account that’s fully yours. Your own contributions are always 100% vested, but employer contributions may vest gradually over time. For example, if your company’s vesting schedule gives you 20% ownership of their contributions each year, leaving after three years means you keep 60% of their contributions, while the rest stays with them. Vesting is an incentive to keep employees for longer, and each employer has different schedules for different positions. Employers are required to provide you with a Summary Plan Description (SPD), which details your retirement plan and will have information about your vesting schedule. Ensure you read the SPD and thoroughly understand your employer's retirement plans.

If your vested balance is under $1,000, your employer can cash it out or roll it into an IRA for you.

If it’s between $1,000 and $7,000, they may automatically roll it into an IRA, a new employer’s plan, or it might be kept with the previous employer's plan with some possible additional fees. Each employer does things differently based on their investment partners, so it's hard to give a catch-all answer.

With $7,000 or more, you usually have four choices:

1. Leave it with your old employer’s plan: Your money can still grow tax-deferred, but you can’t add more to it. There might be some additional fees depending on your employer and their investment partners.

2. Roll it into an IRA: Rolling often gives you more investment choices as traditional brokerages offer more assets and keeps your savings growing tax-deferred. Make sure to roll it over into an account of the same type (Roth vs traditional) to keep your tax advantages.

3. Move it to your new employer’s plan: It's a good idea to check with your new employer to find out if they will accept a rollover from your previous employer’s retirement plan. Managing a single 401(k) plan might be easier for some. Check if your provider can do what’s called a trustee-to-trustee rollover or direct rollover. That’s when your current retirement account provider will send a check to your new provider instead of mailing a check to you, significantly simplifying the rollover process. If your old plan sends the rollover check made out to you instead of your new plan administrator, your old plan is required to withhold 20% of your balance in taxes. You only have 60 days to deposit that money into a tax-advantaged retirement account, like a 401(k), or you could face early withdrawal penalties. Direct rollover is also an option for rollover IRAs.

4. Cash it out: This can trigger taxes and penalties, so it’s typically the least beneficial option.

Keeping your money in a tax-advantaged account, whether with your old employer, your new employer, or in an IRA, can help it grow over time and preserve the benefits you’ve worked hard to earn. Still, if you need money in the short term or have a different type of investment opportunity, this can be a viable option.

How to Invest

To start investing in a personal investment account, i.e., one that is not employer-sponsored, you need to open an account with a brokerage. There are a variety of brokerages to choose from; some of the most popular are listed below.

Each brokerage has a range of different fees and minimum investment amounts; ensure you understand their associated costs before choosing a platform. Additionally, there are sometimes sign-up bonuses through their different partners like NerdWallet or Bankrate. Before opening an account with your preferred broker, see if there are any bonuses available

Some of our personal favorite platforms for beginners are Fidelity, Vanguard, and Robinhood, as they generally have no transaction fees or minimum investments and have easy-to-understand tools. For advanced traders, check out Interactive Brokers for their advanced tools and professional investment guides. This is not qualified investment advice; please do your own research before picking a platform.

When opening your brokerage account, you will be asked what type of investment account you wish to open. More on that in the next section.

Opening a brokerage account can be done in a matter of minutes; it's really that simple. Regardless of the broker, you will need to provide your government ID and your social security number as safety measures against financial crimes. Additionally, some brokerages will require you to fund an account upon creation, but this is becoming less common.

Types of Investment Accounts

There are a variety of investment account types, the main difference between them being their tax advantages and what you can spend the money on. These investment accounts are separate from your employer and need to be created on your own. More about these investment accounts can be found online.

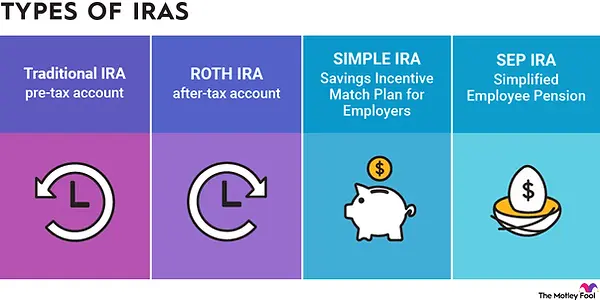

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts are very similar to 401(k) Plans, except they are not employer-sponsored. IRAs can come in both traditional and Roth setups; the choice between them is up to you. More on traditional vs Roth accounts can be found in the glossary or online. IRAs are designed as an additional way for you to save for retirement in a tax-advantaged manner, separate from a 401(k). Funds in an IRA that are accessed before the age of 59 and a half face an aditional 10% tax penalty.

IRAs, both Roth and Traditional, have contribution limits of up to $7,000 per year for those under the age of 50. How much you can contribute to an IRA is based on its setup (Roth vs traditional), your marital status, if you are covered by a workplace plan, and your Modified Adjusted Gross Income (MAGI).

For a single filler covered by a workplace plan contributing to a traditional IRA in 2025, you can deduct the full $7,000 if your MAGI is below $79,000. For a single filler covered by a workplace plan contributing to a Roth IRA in 2025, you may contribute the full $7000 if your MAGI is below $150,000.

More on how to calculate your MAGI, as well as deduction limits, can be found online.

Brokerage Account

A brokerage account is a traditional investment account that offers no tax advantages and has no contribution limits. Brokerage accounts are perfect for any extra money after maxing out your 401(k) and IRA. Brokerage accounts can be opened at any of the financial institutions listed above and more. Brokerage accounts have a wide range of assets to invest in, especially compared to 401(k) plans. Brokerage accounts come with a variety of fees and costs, more of which can be found below and online. Additionally, when you sell assets or are paid interest or dividends, taxes need to be paid on any realized capital gains. The tax rate is dependent on how long you have held the asset and your income level. More on capital gains and investment taxes can be found online.

Health Savings Accounts (HSAs) and 529 Education Plans

Health Savings Accounts and 529 Education savings plans are two additional types of tax-advantaged investment accounts. HSAs are only available to those with High Deductible Health Plans (HDHP) from their employer and are designed to help cover expensive medical treatments. HSAs can be a good idea for healthy individuals who don't anticipate many medical costs. HSAs are highly dependent on your specific situation, and more about them can be found online.

529 Education Savings Plans are designed to help cover the costs of college and other educational pursuits. 529 Plans are usually for parents saving for their kids' future education, but you can also open up an account for your own educational expenses. 529 Plans have restrictions on what the money can be used for, and there are different account setups like prepaid plans. More on 529 plans can be found online.

Introduction to Investing

This course is designed to introduce the fundamentals of investing, with a focus on concepts that are most relevant to beginner investors. While we aim to provide a strong foundational understanding, please note that we are only covering the basics and leaving out many additional details that can be explored through further research online.

The content of this course is primarily influenced by the Boglehead investment philosophy, which emphasizes low-cost, long-term, and passive investing. Although our goal is not to promote any single investment philosophy, we have chosen the Boglehead approach because it offers a simple and effective framework that is especially well-suited for beginners.

Throughout this course, we will explain the differences between various asset classes, such as equities, fixed income, commodities, cryptocurrencies, collectibles, and real estate investment trusts (REITs). We will also discuss common fees associated with each, and the typical reasons someone might choose to invest in them.

Please be aware that the abbreviated definitions provided are intended for general understanding and are not based on legally defined financial terms.

Finally, all strategies and insights shared in this course reflect personal opinions and should not be interpreted as professional or qualified investment advice. Before making any financial decisions or investments, we strongly encourage you to consult with a licensed and qualified financial advisor.

What are funds? What makes funds attractive investments?

An investment fund is essentially a "pool" or "basket" of money that’s collectively invested into a variety of assets and securities. Funds are very attractive investments as they offer exposure to a variety of assets without having to purchase each underlying security. Funds are an excellent way to diversify your investment portfolio with ease.

There are many types of funds, some track specific indexes or benchmarks, while others aim to outperform the market through active management. Funds come in many different forms and vary greatly in terms of structure, goals, fees, and minimum investment amounts.

With over 10,000 actively traded funds in the U.S. alone, we can’t possibly cover them all here. In this course, we’ll go over some of the basics, such as the fees you might encounter, common fund structures, and the difference between mutual funds and exchange-traded funds (ETFs). For more complete and advanced knowledge, check out online resources and contact licensed investment professionals.

Common Investment Fund Fees

Funds can have various fees, generally falling into two main categories: annual fund operating expenses and shareholder fees. While actively managed mutual funds typically have higher operating expenses compared to passively managed ETFs, it's important to be aware of both visible and hidden costs. More on the differences between mutual and exchange-traded funds as well as active and passively managed funds, can be found below.

-

Operating Expense Ratio (OER): This is the most common annual expense. It is a fee ranging from 0.25% to 1% of your investment, charged every year to keep the fund operating. Typically, most costs and fees are included in the OER, but that is not always the case. Actively managed funds that aim to outperform the market with skilled investors usually have higher OERs.

-

Transaction/Commission Fees: A small fee, either a flat rate or a percentage of your investment, paid to the brokerage. Transaction fees tend to be pretty clear costs, but there are some funds that collect fees differently.

-

Management Fees: These cover the cost of hiring fund managers and advisors. They are less common nowadays and are often baked into an OER.

-

12b-1 Fees: Capped at 1%, these cover marketing, selling, and shareholder services.

-

Redemption Fee: Charged if you sell shares within a short time after purchasing them. The redemption fee time limit must be included in the prospectus

-

Exchange Fee: A fee some funds charge when you transfer shares between different funds within the same company. Exchange fees are much less common now and are often replaced by small transaction fees.

-

Account Fee: A charge to maintain your account, often applied if your balance drops below a certain level.

-

Purchase Fee: Paid when you buy shares, distinct from a front-end sales load.

-

Other Expenses: This category includes costs like custodial, legal, accounting, and administrative fees.

Before investing in any fund, make sure to understand all the possible fees that a brokerage might charge. All fees and pertinent information must be included in the fund's prospectus. Luckily, most brokerages now have much smaller fees due to most of the process being automated. The most common type of fund fees is an OER, a purchase/transaction fee, or a sales load, which will be discussed more later. We will discuss the common fees associated with mutual and exchange-traded funds in their respective sections.

Active vs Passive Managment

Funds can be either passively or actively managed. This is one of the most key distinctions between funds as the fees tend to be very different. There are a wide range of passively vs actively managed funds offered through many different brokerages and investment firms.

Actively Managed Funds:

Actively Managed Funds are managed by professionals who choose assets based on research and strategy. These are the funds managed by Wall Street professionals and quantitative traders and are guided by their extensive experience. Picking an actively managed fund is about selecting the investment professionals you personally trust to perform best. Different brokerage firms employ different professionals to manage your money. It is important to understand who is managing your money and what their personal investment philosophy is.

Actively managed funds try to outperform indices or the market to offer higher returns to investors. Each actively managed fund has a different goal or strategy for investing, which should be considered before joining the fund. Each fund's goals and investment strategies must be included in its prospectus; make sure to read it before investing.

Why Choose Active Management?

Investors tend to choose actively managed funds when they want faster, better returns and are willing to pay for such services. Actively managed funds become especially popular during market downturns or in otherwise volatile markets, as funds tied to indexes are underperforming. People looking to mitigate losses or who might need their money in the short term often look to actively managed funds during volatile markets. Fixed-income actively managed funds are often more popular than actively managed equity funds. Actively managed funds are often mutual funds. More on mutual funds can be found below.

Common Actively Managed Fund Fees

Although they offer their expertise, they also come with higher fees due to the active oversight involved. The most common fees in actively managed funds are an OER of around 0.75% and a sales load. Most actively managed funds are mutual funds, and mutual funds typically have sales loads. These are not the only fees that can be associated with actively managed funds, so read the prospectus before investing. Sales loads will be discussed more in the mutual funds section.

Passively Managed Funds:

Passively Managed Funds typically track an index or another benchmark, like the S&P 500, the top 10 tech companies, or real estate development firms, and many more. Passively managed funds usually rely on algorithms and trading models rather than human managers. Because of this automation, fees are generally lower with passive funds. Passively managed funds can be tied to any benchmark or index, giving investors some flexibility. Passively managed funds are typically called index funds as they reflect indexes.

Passively managed funds track indexes and the market and aim to reflect their nature. Passive funds do not try to beat the market; they try to reflect it. It is important to understand the benchmark or index that a passively managed fund is tied to, as the fund's performance is directly reliant on it.

Why Choose Passive Management?

Investors tend to pick passively managed funds when they are investing for a long period of time and want to keep as much of their investment as possible due to lower fees. Passively managed funds are great for beginner investors or those with relatively low net worths who don't want to lose lots of money in fees. Passively managed funds typically have much lower minimum investments compared to actively managed funds, making them more attractive to lower networth individuals. Markets, and their indexes and benchmarks, tend to trend upwards over time at steady rates. By investing in these index funds, you are making a bet that the specific index or benchmark will continue to grow. Passively managed funds are often Exchange Traded Funds, which we will discuss more below.

Common Passively Managed Fund Fees

The most common passively managed funds' fees are an OER and commission/transaction fees when purchasing. An OER of under 0.25% is generally expected for index funds. Additionally, as most passively managed funds are ETFs, there is typically a commission or transaction fee similar to buying a stock. These are not the only possible fees: read the prospectus before continuing. There are more hidden costs associated with ETFs, which will be discussed in the ETF section below.

Mutual vs Exchange Traded Funds

Another major fund distinction is between Mutual and Exchange-Traded Funds (ETFs). The main difference between the two is how and when they are traded, which is discussed in their respective sections.

Mutual funds are typically actively managed and come with sales loads. ETFs are typically passively managed, tied to an index, and come with commission fees when traded. Both types of funds can be either actively or passively managed, but they differ vastly in how they’re traded and structured.

Mutual Funds

The main difference between mutual and exchange-traded funds is how and when they are traded. If you want to buy a mutual fund, transactions are processed only at the end of the trading day. The price is based on the fund’s NAV, or net asset value, which is also calculated at the end of the trading day. This ensures that all investors pay the same price for any given fund on a given day.

Most mutual funds are actively managed, and they usually require higher minimum investments into the fund. Like we talked about, these funds can be open or closed-ended, too.

Exchange Traded Funds:

Unlike mutual funds, ETFs are traded throughout the day, hence their name. ETFs function similarly to stocks, so prices fluctuate constantly, and most investors will buy an ETF at a different price.

Most ETFs are passively managed and tied to indexes like the S&P 500, which means lower fees for investors. Additionally, the minimum investment for an ETF is just one share, making them more accessible to investors with less capital.

Because ETFs trade like stocks, there are a few more things to be aware of. The volume, or the number of trades in a specific time frame, plays an important role in ETFs. The bid/ask spread can be a hidden cost associated with trading ETFs. If ETFs are traded with low volume, the bid/ask spread could be greater. When trying to buy or sell an ETF, one might end up incurring extra costs as there are limited shares trading at bid/ask spread. This is more pertinent to large investors and more on what the bid/ask spread is and how that can affect ETFs can be found by clicking those links or through online research.

ETFS can also trade at a premium or discount relative to the NAV, and it is important to understand if the ETF is trading in such a way. A premium is when the ETF is priced above its NAV, and a discount is when it is priced below its NAV. Very large and popular ETFS often trade very closely to their NAV with very small premiums and discounts. This is because large trading firms are able to quickly capitalize on the small price differences. If you are investing in smaller, less tracked ETFs, that is where they might trade at premiums or discounts of 1% or higher.

.

Mutual Funds: Sale Loads

Sales Loads are commissions paid to brokers when you buy or sell fund shares, either upfront (front-end) or upon sale (back-end). Funds that charge sales loads are known as load funds, and those that don’t are called no-load funds. Sales Load funds are split up into different classes

-

A front-end load, also called Class A shares, is a one-time fee paid by the investor when the shares are purchased.

-

A back-end load, or Class B shares, is a one-time fee paid when shares are sold.

-

Level load funds, also known as Class C shares, have yearly charges and are a fixed percentage of the fund's assets.

-

Class A and B Load funds typically include most fees aside from an OER into the load fee. This means load funds can make fee costs more streamlined and less noticeable as the fee is paid immediately when the security is bought or sold. While no-load funds have no sales commissions, they might still have other fees, such as redemption, exchange, account, and purchase fees. Additionally, brokers may charge transaction fees when buying or selling mutual funds, which can range from $10 to $75.

-

It’s important to consider the long-term impact of fees. Even small differences can add up over time, making a big difference in your returns.

Closed vs Open Ended Funds

Open-Ended Funds:

These are the most common types of funds, and this means that the fund can issue new shares continuously.

Investors buy shares directly from the fund company, and the value is adjusted daily based on the Net Asset Value (NAV). Most funds are open funds because they allow for constant investment into the fund.

There is no dilution amongst investors because new shares are being created and old shares are being redeemed, keeping a balance. The value is adjusted daily in accordance with the amount of shares.

Closed-Ended Funds:

These funds issue a fixed number of shares upon their initial creation. While less common closed-ended funds are still popular.

Unlike open-ended funds, their price is determined by investor demand, not NAV. As a result, shares may trade at a premium or discount to NAV. Closed-ended funds are less common and, because of their demand, are not very relevant to beginner investors. Many closed-ended funds have high minimum investments and are meant for those with millions to invest.

Final Thoughts on Funds

Funds come with various structures, fees, and management styles. Understanding these basics will help you make more informed investment decisions and hopefully make you more money. Always do your research before investing, read each investment's prospectus, and be sure to consult with a licensed investment advisor and tax attorney to understand what’s best for your individual situation. Please remember that the information presented in this course is intended to be a starting point for your investment journey. We are in no way giving qualified investment or financial planning advice; we are simply sharing our personal opinions and information aggregated from reputable online sources. Again, please do your research before investing, read each investment's prospectus, and be sure to consult with a licensed investment advisor and tax attorney to understand what’s best for your individual situation.

That being said, in our non-qualifed personal opinion, for many young investors and relatively low networth individuals, low-cost ETFS that track indexes are a perfect start. Check out bankrate and other online sources for investment recommendations. Make sure to know the risks before investing as well; every investment comes with risk.

Investing in Stocks

What are Stocks?

When you purchase a stock, you’re essentially buying a small piece of ownership in a company relative to the number of shares you purchased. The term stock refers to the financial instrument used to issue shares. Shares are the individual "slices" of stock and, therefore, the "slices" of a company. More on stocks vs shares can be found in the glossary or online.

Stock ownership can come with certain rights or privileges, depending on the company, so it’s important to know what you’re getting into. Some stocks give voting rights or entitle you to go to shareholder conferences, which can give you an actual say in important company decisions. Generally, you need to own a large amount of stock in a company to have impactful voting rights, but many companies will still listen to smaller shareholders.

Additionally, some stocks offer dividends, which means they share a portion of their profits with their shareholders. Dividends can help offer a steady cash flow on your investments, making them attractive to some investors. Not all stocks offer dividends, and you often need a significant amount of shares to see any real cash flow. Still, dividends can be an excellent way to get some consistent cash from your investments.

Where to Invest in Stocks

There are a variety of places to invest in stocks; they can be purchased at any of the brokerages and investment firms listed above, and some other ones that can be found online. Stocks can be assets invested in employer-sponsored investment accounts and Individual Retirement Accounts. More about where and how to invest can be found above.

Why Invest in Individual Stocks?

At its core, investing in individual stocks is about choosing companies that you personally believe will succeed and grow over time. These are generally long-term investments, meaning you’re buying with the intention of holding for years, not weeks or months.

However, buying individual stocks does come with its risks. If the company doesn’t do well, you could lose a significant amount of money. Lots of investors compare investing in single stocks to gambling. It can be a lot like placing a bet on a company’s success at the poker table, except you're playing against Phil Ivey and he has 10 times your stack.

Still, many investors choose to invest in stocks that they believe in, and some stocks do show steady, consistent growth over time. That being said, investing in individual stocks should be approached with caution and should generally make up a smaller portion of your overall investment portfolio. Don't overinvest in individual stocks when you can easily invest in funds that often have higher returns and better diversification.

Again, this is not qualified investment advice and instead reflects our personal opinions. Please speak to a qualified investment professional before making any decisions.

Common Stock Fees

The most common fee associated with stock trading is commissions. Commissions help cover the costs of brokers making trades for you. Commissions can either be a fixed dollar amount or a small percentage of your investment.

There are a variety of platforms that offer no commission trading for stocks, which reduces your fees. We really suggest choosing one of these platforms to avoid paying any unnecessary fees. Check out some of the brokerages listed above and do your own research to pick one that's best for you.

Final Thoughts on Stocks

Investing in individual stocks can be risky as they offer limited diversification. There are advanced stock trading techniques like options and margin trading, which are beyond the scope of this course. For more information on advanced stock trading, check out Interactive Brokers' online courses.

Our personal recommendation, in line with the Boglehead Investment Philosophy, is to avoid individual stocks and instead invest in funds. Funds offer much better diversification and therefore come with lower risks. There can be some advantages to investing in individual stocks, but for most beginner investors or low-net-worth individuals, funds are the way to go. Remember to always do your own research and check with licensed professionals before making any investment decisions.

Fixed-Income Securities

Fixed income securities are a type of investment that offers predictable income through consistent interest payments. You can expect a consistent, fixed income from these assets, hence their name.

The most common fixed-income securities are bonds and certificates of deposits (CDs). When you invest in a bond, you are essentially lending money to a company or organization with the promise of repayment plus interest. The amount of interest and its payment schedule is called the Coupon Rate and applies to any fixed income securities.

Bonds can be issued by companies and governments alike, giving you a variety of entities to invest in. CDs, on the other hand, are deposits you make with a bank that you agree not to touch for a set number of years. Both bonds and CDs are typically long-term investments, with terms often stretching 10, 20, or even 30 years.

All About Bonds

As mentioned above, bonds are essentially loans that you give to a company or government with an expectation of full payback plus regular, fixed interest payments. Bonds can be issued at all levels of government, including the federal, state, and municipal levels. Government-issued bonds are typically tax-free, but not always; more on that below and online.

Bonds are given a risk rating by one of the three major bond rating corporations, S&P Global Ratings, Fitch, and Moody's. Bonds offer a low rate of return on your investment but are generally very low-risk, which is an attractive trade-off for many investors. Bonds can be an excellent long-term investment with a guaranteed return rate and consistent interest payments, especially when compared to a regular savings account.

Some individual bonds can be hard to sell before the maturity date, so make sure you don't need the money invested in the bonds soon. Bond funds, on the other hand, are often easier to sell and come with all the benefits of "regular" funds. Consider investing in bonds and bond funds to lower the overall risk of your investment portfolio.

Why Invest in Bonds?

Bonds can be an attractive investment for long-term investors looking to lower their risk and diversify their portfolio. Bonds offer a guaranteed return plus consistent interest payments, giving you consistent income.

United States federal bonds, also called treasury bonds or t-bills, are generally thought to be one of the safest investments out there as they are backed by the full faith and credit of the United States. Ratings for t-bills have been downgraded, but are generally thought to be the safest investments by the public and most investors.

Bonds, especially those issued by the government, typically have very low return rates due to their guaranteed payback nature. Investing in bonds is a compromise between return rates and security. Generally, people invest more in bonds when they are less risk-averse, looking for good diversity, or need their money relatively soon. Our personal, unqualified recommendation for young people is to invest in bond funds to gain exposure to a variety of bonds. More on bonds can be found online.

Bond Ratings

Bonds are given ratings by three major agencies, Standard and Poor's Global Ratings, Moody's Investor Services, and Fitch Ratings. Each bond rating service has its own ranking system and notation to classify bonds. Investors typically have to pay for these ratings, although some are available online.

Rating agencies have their own methodologies for rating bonds, meaning that their ratings will vary slightly from one another. Investors should look at each agency's rating for a specific bond to determine its creditworthiness.

The chart to the right provides a general breakdown of each agency's ratings and what they mean. Remember to always do your own research and consult with a licensed investment professional before investing.

How to Invest in Bonds

Bonds can be bought directly through the issuer, purchased on the secondary market, or by buying into a fund. Buying a bond directly from the issuer, especially states and municipalities, can be difficult and might come with high minimum investments.

Generally, our personal unqualified advice is to invest in bonds through funds, which can be purchased just like any other fund through a broker. Retirement accounts often have bond funds as well, making them attractive diversification options. Bonds are a unique investment, and there is a lot of discourse regarding bond strategies. In-depth investment strategies are beyond the scope of this course as they vary greatly depending on your individual situation. As always, do your own research and consult with a licensed professional before making any investment decisions. Investment professionals really shine with bond knowledge and strategies.

Who Issues Bonds?

Bonds are issued by governments and companies alike. Government bonds are issued at the federal, state, and municipal levels, and each offers different tax advantages. Foreign governments also issue bonds, although directly investing in those can be more difficult and usually requires buying into a fund. Corporations also issue bonds as an alternative way to raise money without giving away equity. Governments and corporations often issue bonds to fund new projects, acquisitions, or even new infrastructure.

Government bonds sometimes offer tax advantages for bond purchasers, making them an even more attractive investment. Federal government bonds are typically exempt from state and local taxes, but are often taxed at the federal level. State and municipal bonds are typically exempt from local, state, and federal taxes if you reside where the bond was purchased. Not all bonds are tax fee and bonds purchased on the secondary market are usually subjected to more taxes. More on how bonds are taxed can be found online.

.